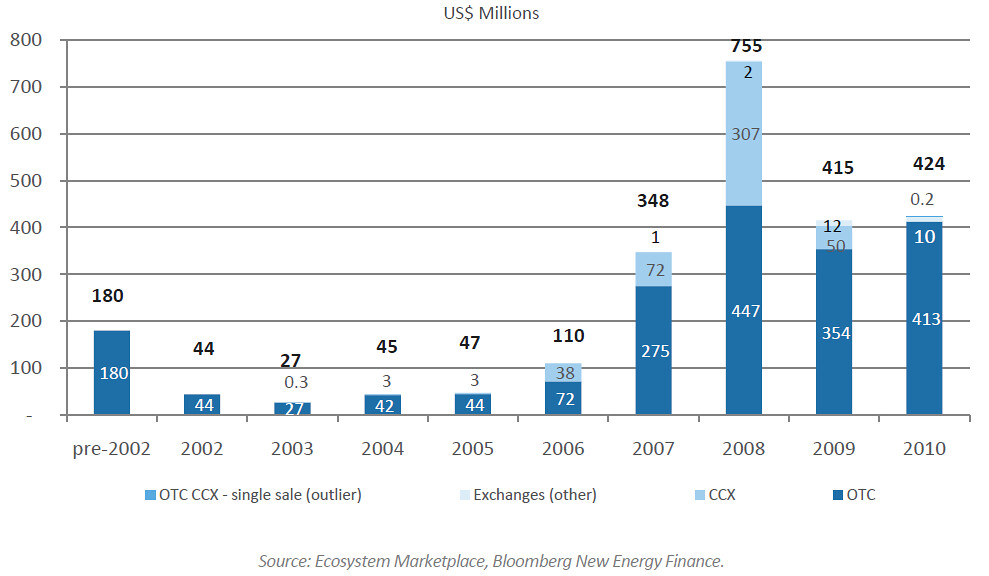

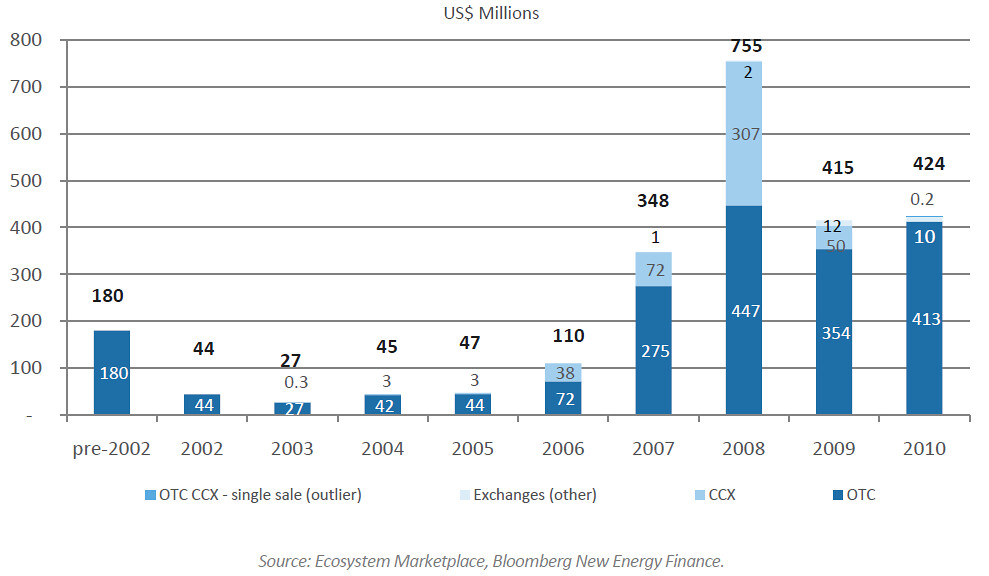

Voluntary Carbon Markets encompasses any transaction of carbon credits outside the scope of the mandatory or compliance driven market mechanism. Despite being consistently attacked as a greenwash tactic by Big Corporate, it has its benefits too, which might explain it consistent growth in the last decade (save the last 2 years for the economic downturn). A large part of the growth has been driven by companies committing themselves to sustainability and turning 'carbon neutral'.

|

| Historic Volume in the Voluntary Carbon Market |

Apart from institutionalised promotion, there has also been a considerable progression in accepting the importance of Voluntary Carbon Markets. Despite the negativity associated with the idea of a ' free market association' tackling climate change, there are definite attributes in the Voluntary system which provides a unique advantage. These are most common arguments put forward for the VCS:

Scope: Only a relatively few companies and countries are covered by the mandatory Cap & Trade regulations. The remaining industries and individuals (who consider it their environmental responsibility) outside the latter's scope are thus provided with an invaluable opportunity to reduce their carbon footprint, especially in those countries which haven't ratified Kyoto.

Innovation & Preparation: Voluntary schemes serve as an excellent way for experimenting with new mechanisms & technologies which may be applied in a later period to regulated and compliance based markets. It invariably expedites the process of gaining experience with various components of the the carbon market i.e. inventories, CER's, etc. for a possible future participation in a more mature regulatory carbon market.

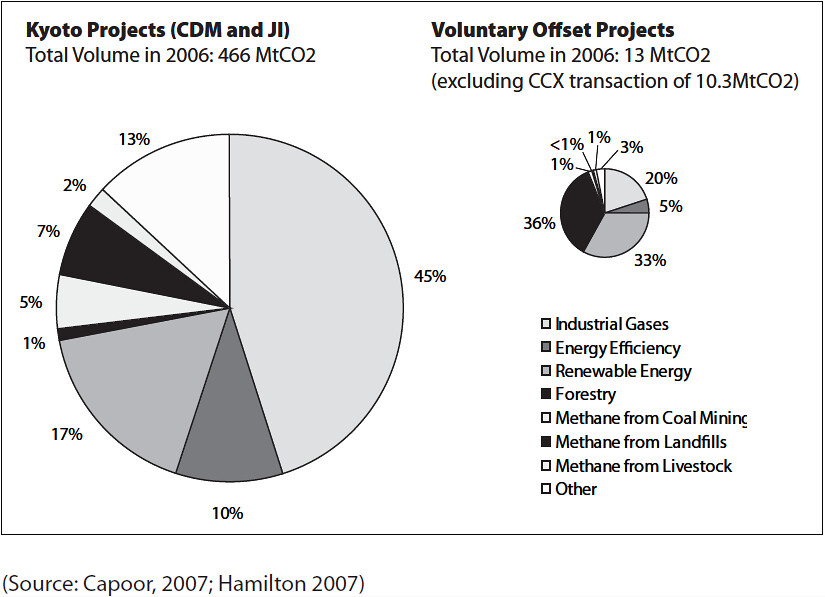

Flexibility & Diversity: The expected lack of administrative control and management burden due to the nature of voluntarism serve as an advantage for micro level or decentralised green projects that obviously would have been ignored in a larger regulatory cap & trade scheme.There is undoubtedly a considerable potential for a diverse range of niche projects like agricultural soil, livestock, landfill, coalmine methane (Apart from the conventional projects of renewable energy, efficiency, etc.)

Corporate Goodwill : One of the strongest reasons for corporate participation; involvement in Voluntary Markets creates an environmental badge easily recognisable by the public or the shareholders thus increasing the eco-brand value of the corporation.

Efficiency: Controversially put forward by fierce advocates of voluntary standards; it is claimed that widespread corporate & industrial participation reduces the cost of emission reductions thus making the voluntary market much more appealing while accelerating the pace of Eco-friendly development.

The voluntary markets clearly incentivise an individualistic action to tackle the larger question of climate change, and sustainability.

|

| Chicago Climate Justice activists protesting against Cap and Trade |

Having analysed its benefits it is also imperative to understand that the nature of voluntarism in this carbon market also creates a want for reciprocation amongst the participants. Most of the industries who partake spend most of the investments in a particular type of offsets.

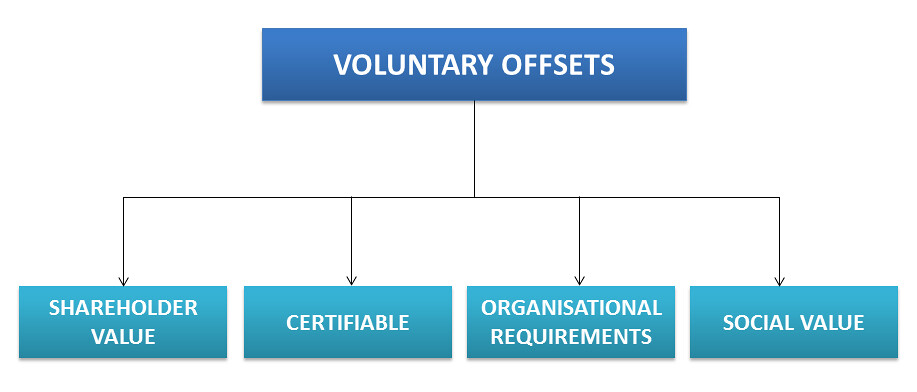

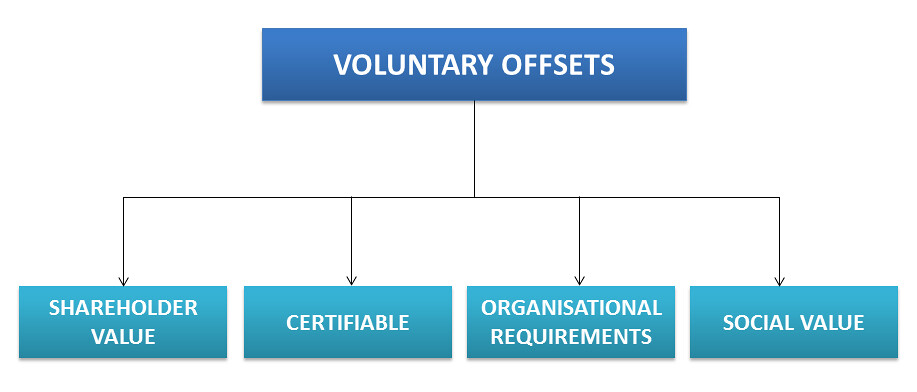

Unfortunately there is more effort spent on displaying the involvement in reducing emissions and its consequential effect rather than on actually reducing emissions. The natural outcome of this approach is the tendency to invest in offsets which create desired effects:

Stakeholder Appeal : Offset investment should be displayable to shareholders and investors. Increases the potential brand value of the organisation .

Consumer Loyalty : Displaying the environmental portfolio has the distinct advantage of increasing customer approval in an increasingly environmentally conscious populace.

Social Side Benefits: The offset program should also be able to contribute to the quality of life in the area where the project is undertaken as it projects corporate social responsibilty.

Offset quality: The offset must be certifiable by the verifying agencies/regulators.

|

| The desired effects of the voluntary offsets |

Despite all its inherent drawbacks it is to be considered that the carbon market is an efficient mechanism to only determine the cost of emissions. Reducing and ultimately eliminating emissions remains dependent on the socio-political will of the participating individuals and organisations in the system.

......................................................................................................................................................................